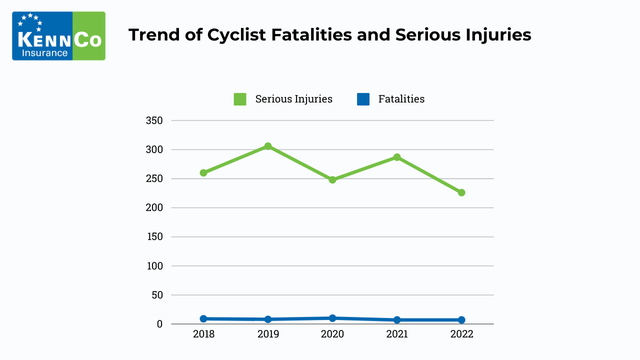

An RSA study into long term-trends for fatalities and serious injuries among cyclists shows that, between 2018 and 2022, there were 41 cyclist fatalities and 1,327 serious injuries.

Prepared with data from the Irish Road Traffic Collision Database and collision records from An Garda Síochána, the report provides an in-depth analysis of fatalities and serious injuries to cyclists on Irish roads over a 4-year period, with statistics on demographics, times and locations where collisions occurred, collision type and driver actions.

Alarmingly, it found that cyclists accounted for 6% of all road fatalities and 19% of serious injuries. With 8 cyclists fatally injured and 265 seriously injured each year on average – roughly 32 cyclists sustained serious injuries for every fatality.

Safer Roads for Cyclists: Types of Collision

The RSA study found that the majority of cyclist fatalities (73%) involved collisions with another vehicle. While 82% of serious injuries occurred as a result of multiple vehicle collisions, and mostly involved other cars and light goods vehicles.

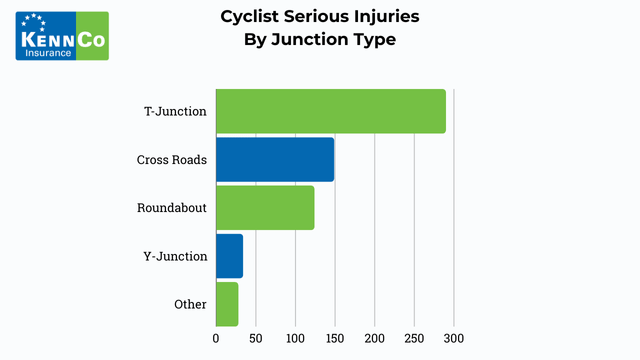

Interestingly, most serious injuries occurred on straight roads (81%) or at junctions (47%), with T-junctions and crossroads being the most common places for a collision to occur.

For single vehicle collisions, 88% of cyclists who were seriously injured were driving forward; with 16% losing control of their bike.

For collisions involving multiple vehicles, 88% of cyclists were seriously injured whilst driving forward and 3% were injured while turning right; while the stats for drivers show that 47% were moving forward, 15% were turning right and 11% were turning left. A failure to observe was noted as the most common action for both drivers (38%) and cyclists (18%) in multi-vehicle collisions.

Safer Roads for Cyclists: Accident Demographics & Trends

The RSA study also lends insight into where and when collisions involving cyclists happen and listed a significant portion of serious injuries (82%) of having during daytime hours – which also acts to highlight the need for hi-visibility measures even during the daytime.

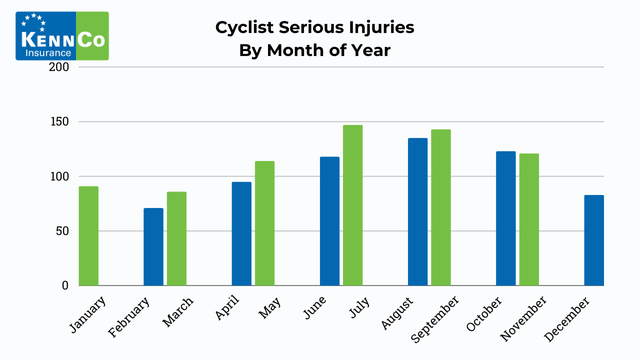

Of those incidents, the majority of fatalities (78%) and serious injuries (80%) involving cyclists occurred between 8 AM and 8 PM. With instances of serious injuries peaking in July and September, reflecting increased cycling on the road during the summer months.

Going a little deeper, the study showed that cyclist fatalities were most common on Sundays (32%), while serious injuries were more evenly distributed, although with a slight increase early to mid-week.

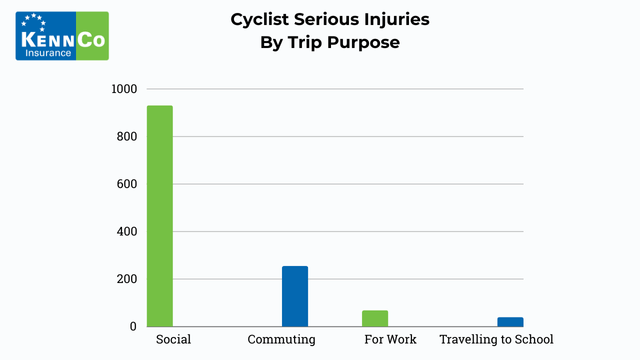

A significant share of serious injuries (72%) occurred during social cycling, while 20% of serious injuries to cyclists happened while commuting. With two-thirds of fatalities involving cyclists happening on rural roads with higher speed limits.

This is in contrast to findings for serious injuries involving cyclists which occurs most often in urban areas. The two counties with the highest number of cycling fatalities and serious injuries were Dublin and Cork – with Dublin alone accounting for more than half of the serious injuries recorded.

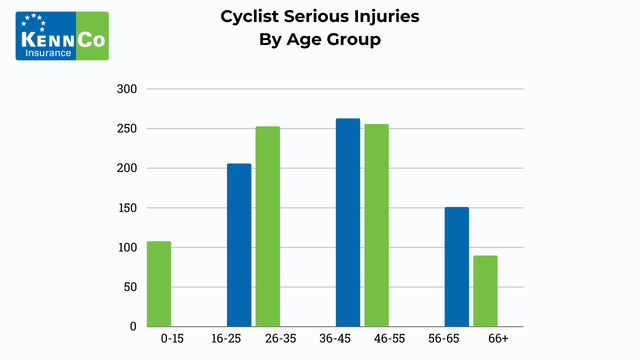

Males accounted for the majority of cycling fatalities (90%), with the highest fatality rate among males aged 56 – 65 (29%). Similar results were recorded for serious injuries to cyclists with males accounting for 79% – with the highest rate of serious injury among those aged 36-45 (20%).

Safer Roads for Cyclists: Key Findings from RSA Report

- In the four year period from 2018 and 2022, there were 41 cyclist fatalities and 1,327 serious injuries.

- On average, 8 cyclists were fatally injured and 265 were seriously injured each year.

- Cyclists accounted for 6% of all road fatalities and 19% of serious injuries.

- Approx. 3 in 5 cyclists seriously injured were aged 26-55 years – with the cyclist most likely to be male.

- For every cyclist fatality, approximately 32 cyclists sustained serious injuries.

- Over 8 in 10 cyclists were seriously injured in multiple vehicle collisions – most commonly with a car or light goods vehicle.

- A higher proportion of serious injuries occurred on Monday – Thursday, and in Summer months. With four in five injuries to cyclists happening between 8am and 8pm.

- Almost half of serious injuries occurred at a junction; while the majority of injuries were sustained on a straight road.

- 2018 and 2022, there were 41 cyclist fatalities and 1,327 serious injuries.

- On average, 8 cyclists were fatally injured and 265 were seriously injured each year.

- Cyclists accounted for 6% of all road fatalities and 19% of serious injuries.

- For every cyclist fatality, approximately 32 cyclists sustained serious injuries.

- Cyclist injuries peaked from May to September. Evening and morning rush-hour are the times when cyclists are most likely to be injured.

- Over 8 in 10 cyclist injuries occurred in built-up areas rather than in rural areas.

What Can Cyclists Do To Protect Themselves?

Cyclists are among the most vulnerable road users so need to practice good road safety and awareness to keep themselves and other road users safe. The RSA has the following safety tips for cyclists:

- Never cycle in the dark without adequate lighting. Remember, it’s having a bell on your bike working lights at all times is a legal requirement.

- Wear a helmet. Helmets are an essential, and often live saving, piece of equipment for cyclists. While not required by law, a helmet should be worn at all times while cycling for road safety and personal protection.

- Always wear luminous clothing such as hi-vis vests, fluorescent armbands and reflective belts so that other road users can see you.

- Maintain your bike properly and keep it roadworthy – in particular, your brakes should work properly, and your tyres should be inflated to the right pressure and be in good condition.

- Make sure you keep to the left. Always look behind and give the proper signal before moving off, changing lanes or making a turn.

- Steer clear of left-turning trucks/buses: let them turn before you move ahead.

- Remember, if you cannot see, the driver cannot see you.

- Watch your speed, especially when cycling on busy streets and going downhill.

What Can Drivers Do To Protect Cyclists?

While cyclists have a responsibility to follow the rules of the road and practice good road safety to protect themselves, drivers also need to play their part by being extra mindful when they encounter cyclists or pedestrians on Ireland’s roads. Simple actions and behaviours by drivers can make the roads safer for cyclists and other vulnerable road users. These include:

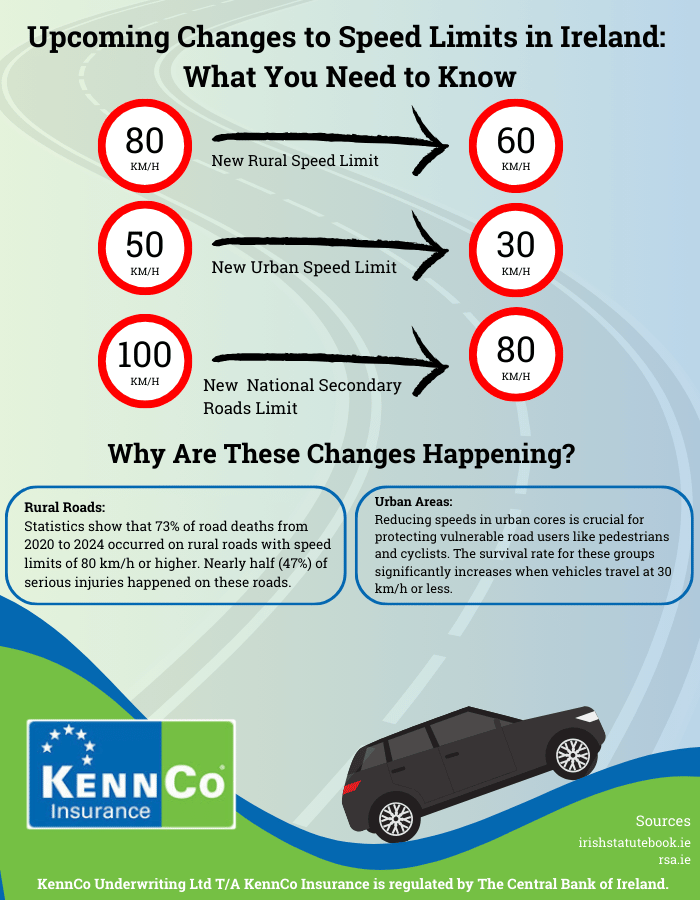

- Drivers should keep a safe distance when overtaking cyclists on urban and rural roads. Giving at least a 1 metre clearance when overtaking a cyclist on roads of 50 km/h or under, and at least 1.5 metres on roads over 50 km/h.

- Drivers should choose a speed that is appropriate for the environment and their surroundings. This is especially true when sharing the road with cyclists and pedestrians.

- Drivers should watch out for cyclists in their blind spots, junctions and roundabouts especially when turning left or right.

Looking to Save On Your Car Insurance?

At KennCo, our car insurance cover offers competitive rates and valuable benefits, including a replacement car as standard. Get peace of mind knowing you’re fully covered.

Get a Secure Quote Today

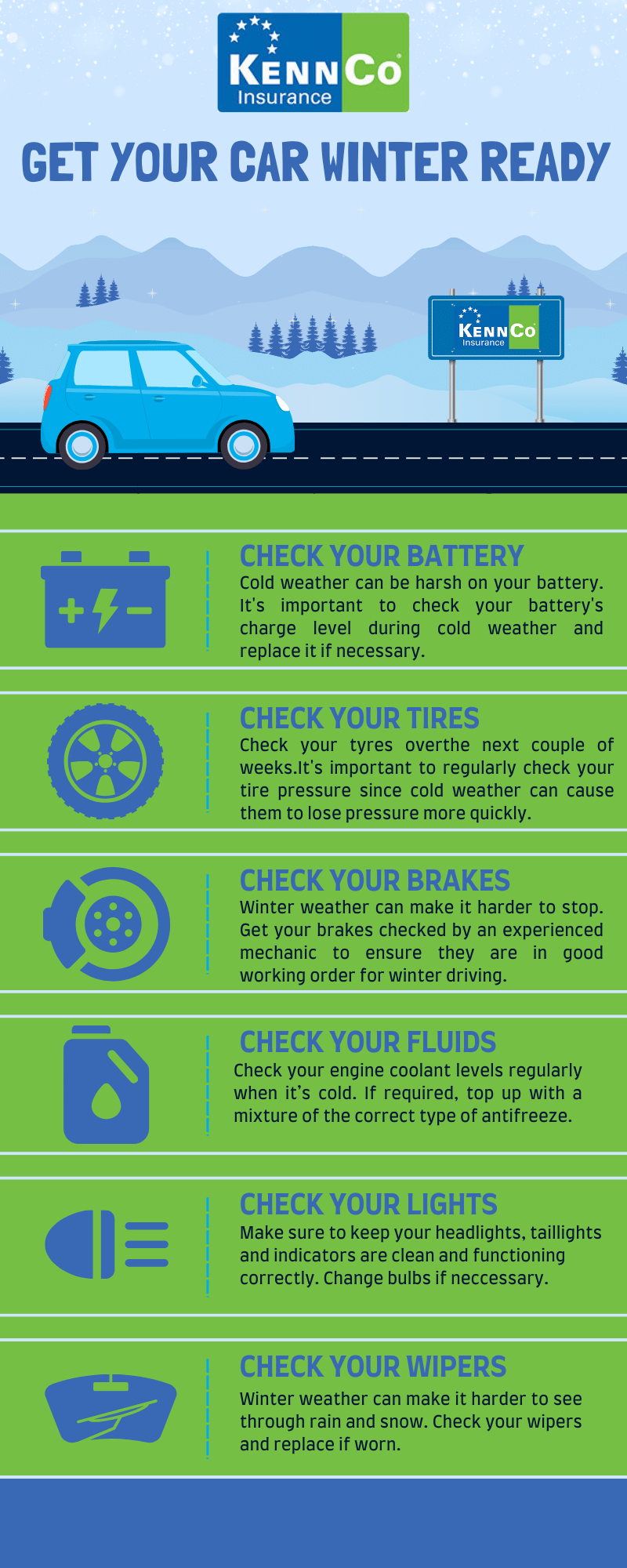

As winter is nearly upon us again, we advise drivers to service their vehicles and carry out a few simple precautions so you can drive safely over the winter months. Don’t get caught out this winter. Make the necessary checks on your vehicle now.

As winter is nearly upon us again, we advise drivers to service their vehicles and carry out a few simple precautions so you can drive safely over the winter months. Don’t get caught out this winter. Make the necessary checks on your vehicle now.